- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Oracle’s (ORCL) Unusual Options Activity is Helping to Suppress October Call Spreads

To be quite direct, analysis on unusual options activity shouldn’t be treated like a balance sheet reading, as in a snapshot in time. Rather, the metric should be considered as part of an evolving picture. For Oracle (ORCL), the cumulative impact of highly aberrant transactions in the derivatives arena may have just helped create a discounted opportunity, especially in ORCL stock debit call spreads.

Let’s unpack some intriguing details. On Monday, Oracle represented one of the top movers among mega-capitalization enterprises, with its equity gaining 3.41%. Not surprisingly, ORCL stock also made the ranks of Barchart’s screener for unusual options volume, with the main metric hitting 504,709 contracts. This figure represented a 58.55% lift over the trailing one-month average.

In terms of the breakdown, call volume hit 345,328 contracts while put volume was 159,381 contracts, generating a ratio of 0.46. On paper, this relationship appears bullish. However, options flow — which focuses exclusively on big block transactions likely placed by institutional investors — showed that net trade sentiment slipped $2.56 million below parity, thus favoring the bears.

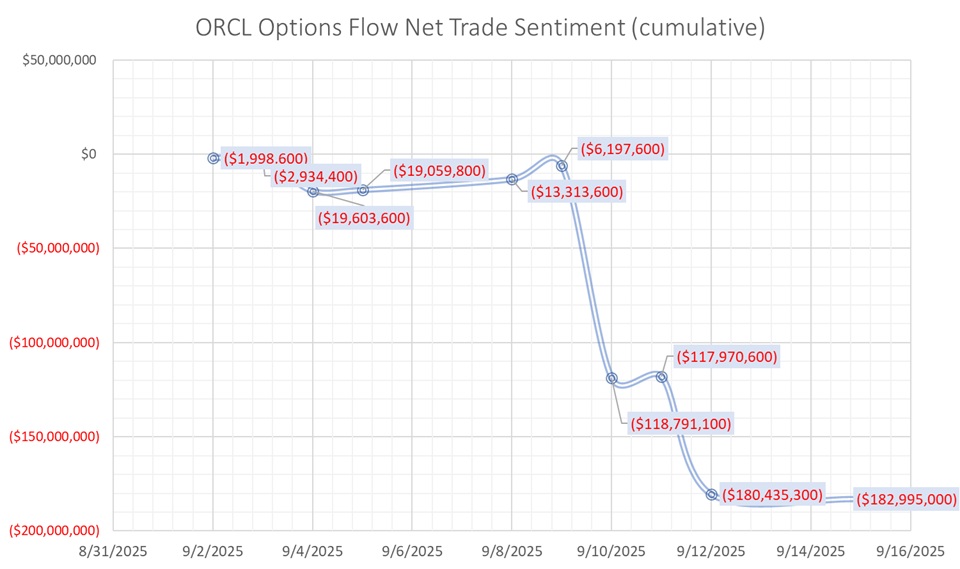

What’s more noteworthy, though, is the month-to-date picture. Cumulatively, September’s net trade sentiment sits at nearly $183 million below parity. To be fair, some of the numbers that make up this tally hail from already-expired options. However, the majority of the bearish activity is attributed to sold (credit-based) calls.

Specifically, likely institutional traders have sold $131.625 million worth of $230 calls expiring Oct. 17, 2025. With a bid of $112.50, the effective cap on the credit side is $342.50. At time of writing, ORCL stock is $302.14, which means that the call sellers (writers) have locked in a sale price while front-loading a good chunk of the proceeds.

In other words, ORCL stock could be anticipated to encounter momentum loss heading into mid-October. That’s where an opportunity for the debit buyer may come into play.

ORCL Stock is Priced Attractively for a Debit Scalp

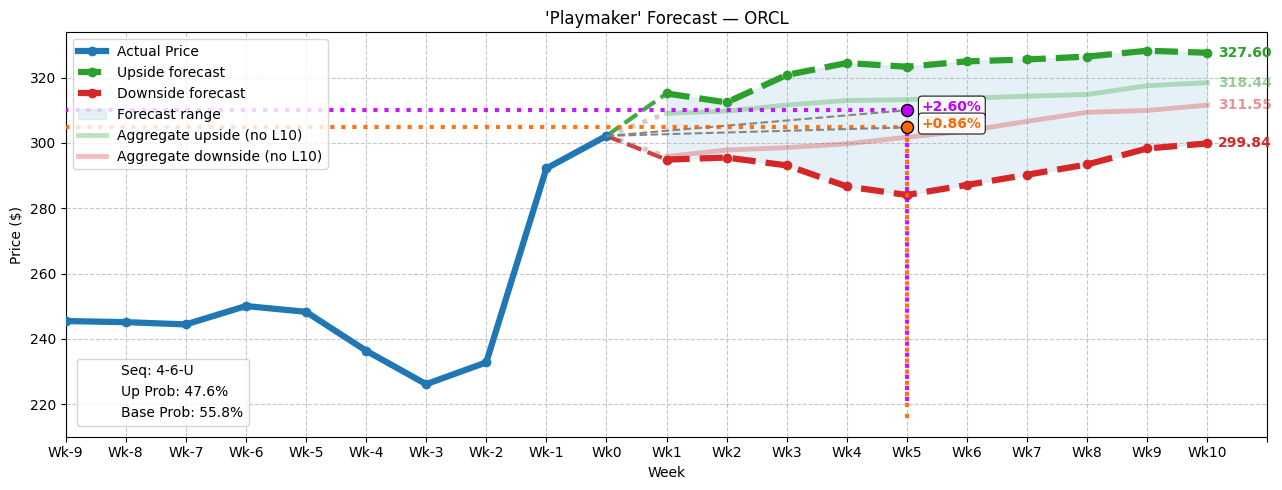

Quantitatively, the picture for ORCL stock is somewhat ambiguous. In the trailing 10 weeks, the security is printing a 4-6-U sequence: four up weeks (defined as the return between Monday’s open and Friday’s close), six down weeks, with an overall upward trajectory. Since January 2019 to July 2025, this sequence has flashed 21 times. In 14 occurrences, ORCL has been in positive territory 10 weeks later, implying a 67% long-side success ratio.

To be fair, I don’t want to read too much into that attractive statistic. Frankly, projecting probabilities that far out introduces compounded errors. Further, the stock market is an open, entropic system. Exogenous factors can easily enter the paradigm and completely ruin expected probabilistic pathways. So, take the 67% odds of success with a grain of salt.

That said, what I do find interesting is the cumulative effect of Oracle’s unusual options activity. Because sophisticated traders are likely aware of the huge overhang in sold calls that will be exercised on Oct. 17 — unless ORCL stock falls below the $230 strike price — the debit side has been discounted. That’s not shocking because there should be a momentum overhang as we move into October.

Because the sold calls are deep in the money (ITM), they shouldn’t be treated as traditional income plays. Instead, they should be framed as pre-sold securities. Given that the Sept. 10 session saw net trade sentiment fall to $112.59 million below parity (notably after Oracle delivered blockbuster earnings), this is a major event circled on Wall Street’s calendar.

I can’t guarantee anything. However, it’s likely that ORCL stock debit call spreads have been cheapened to incentivize speculation. It may not be a bad bet.

Essentially, market makers don’t anticipate a higher move in ORCL stock since the security has already gained so much (up 21.3% in the trailing month). Combined with the sold calls, there’s a reasonable expectation of slowed momentum. However, the bet is that if momentum isn’t that slow, a debit wager could be attractive.

Taking the Offer on the Table

At this moment, the multi-leg strategy that arguably looks the most enticing is the 300/310 bull call spread expiring Oct. 17. This transaction involves buying the $300 call and simultaneously selling the $310 call, for a net debit paid of $475 (the most that can be lost in the trade).

Should ORCL stock rise through the second-leg strike price ($310) at expiration, the maximum profit is $525, a payout of roughly 111%. Breakeven comes in at $304.75, which is less than 1% from the current market price. For the trade to be fully profitable, ORCL would need to rise 2.6%, which I would imagine would be a very reasonable target.

Yes, Oracle now carries a rich premium thanks to its post-earnings boost. However, it’s also based on a fundamentally stout business. As Monday’s big pop demonstrated, there’s still a lot of belief in ORCL stock — I’d say enough belief to send shares 2.6% higher over the next five weeks.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.